howard mcsweeney1- Location: Dover

- Registered: 12 Mar 2008

- Posts: 62,352

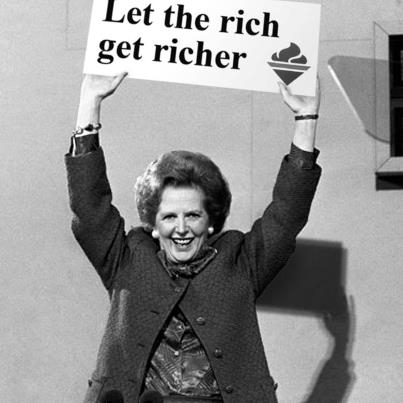

the situation demands that we return to the good old days.

Guest 655- Registered: 13 Mar 2008

- Posts: 10,247

And why not Howard if the result is 'the greater good' by which I mean more tax revenues being generated, more jobs being created and more much needed economic growth that we all need.

The idea that wealth is a fixed amount that can be redistributed around without damaging consequences bears no relation to reality.

If people were to focus on what is really needed and the problems we have then you would ignore the fact that some people are rich and may get richer as it has no relevance. The problems are of excessive government spending and borrowing (individual borrowing also being a problem), the wrong type of borrowing, the lack of economic growth and an over complex tax system that discourgages wealth creation.

Keith Sansum1

- Location: london

- Registered: 25 Aug 2010

- Posts: 23,948

oh that lady

and im biting my tongue so well jan!!!!!!

ALL POSTS ARE MY OWN PERSONAL VIEWS

Brian Dixon

- Location: Dover

- Registered: 23 Sep 2008

- Posts: 23,940

looks like the bag lady I saw earlyer in town.

Keith Sansum1

- Location: london

- Registered: 25 Aug 2010

- Posts: 23,948

naughty brian

ALL POSTS ARE MY OWN PERSONAL VIEWS

Guest 716- Registered: 9 Jun 2011

- Posts: 4,010

Tax avoidance is Public Enemy No 1

'Big four' accountants 'use knowledge of Treasury to help rich avoid tax'

Experts offering advice on legislation they helped to create is 'ridiculous conflict of interest',

Margaret Hodge MP has called on the**************** Treasury to stop accepting staff from the

'big four' accountancy firms when drawing up new laws**************.

The so-called "big four" accountancy firms are using knowledge gained from staff seconded

to the Treasury to help wealthy clients avoid paying UK taxes, a report by the influential

Commons public accounts committee says.

Deloitte, Ernst & Young, KPMG and PricewaterhouseCoopers have provided the government

with expert accountants to draw up tax laws. But the firms went on to advise multinationals

and individuals on how to exploit loopholes around legislation they had helped to write, the

public accounts committee (PAC) found.

Margaret Hodge, the PAC's chair, said the actions of the accountancy firms were tantamount

to a scam and represented a "ridiculous conflict of interest" which must be stopped.

"The large accountancy firms are in a powerful position in the tax world and have an

unhealthily cosy relationship with government," she said, calling for the Treasury to stop

accepting their staff to draw up new tax laws......................

Guest 655- Registered: 13 Mar 2008

- Posts: 10,247

I actually have some sympathy and agreement on this issue. The Treasury have a problem, all the most talented, creative and clever tax advisers want to earn the big bucks that the big four will pay. HMRC really cannot afford them and there would be a public scandal if they did try to make the kind of pay offer that would be required to tempt them away. So HMRC are like a man with a bow and arrow up against someone with an assault rifle. They are simply out matched. There is no real solution and clearly this kind of outsourcing can be counter-productive.

Incidentally, the 'big four' accountancy firms have a vested interest in a complex tax system charging high taxes so that is why they can command such high fees and salaries.

The system is not working and a massive re-think needed.

As I have said a root and branch reform of the system to low, flat and simple taxes is what is needed. The big accountants will hate it, their fox will have been shot and those massive fees will no longer be justified.

Guest 716- Registered: 9 Jun 2011

- Posts: 4,010

HMRC`s accountants are not as sharp as the Tax avoidance Johnnies...............

HMRC say we lose £ 5 billion to Tax avoidance..............

The smart arsed Tax avoidance Johnnies say they save their clients £ 30 billion ................

How do we beat the Finance Johnnies ?

.Margaret Hodge: tax avoidance costs the Treasury £5bn a year

• Rich running rings round HMRC, says Margaret Hodge

• Call to name and shame promoters of avoidance schemes

Margaret Hodge wants HMRC to 'robustly' stamp out tax avoidance promoters.

The exchequer loses at least £5bn a year because the taxman is failing to crack down on

"morally wrong" tax avoidance schemes similar to the one used by comedian Jimmy Carr, .

Margaret Hodge, the former Labour minister, said rich businessmen designing the schemes

were "running rings" around HMRC.

She said HMRC had an "appallingly bad record" at catching tax cheats, having fined just 11 people

for promoting tax avoidance since 2004 - despite 10,000 people a year coming forward to report tax

avoidance schemes.

A report by the PAC published on Tuesday says there is "a lot of money to be made in selling

avoidance schemes", and commissions paid to the creators of the schemes can be up to 20%

of the tax saved.

Hodge told Lin Homer, chief executive and permanent secretary of HMRC, that she didn't want to be

"aggressive and awful about it", but the agency's failure to crack down on tax avoidance was "gobsmacking".

"There has been huge growth, and appalling proliferation [in tax avoidance], and what has HMRC

been up to? It has only taken 11 cases to tax tribunals," she said.

The 11 tax avoidance promoters taken to tribunal were fined just £5,000 each despite the

maximum penalty being £1m. Hodge said HMRC had never fined an individual for failing to

disclose a scheme on their tax return.

Hodge said HMRC must "robustly" crack down on tax avoidance promoters that are

"costing the country billions, as the public are struggling with less money in their pockets".

************* She added: "It offends the sense of fairness."***************

She called on tax avoiders and the businesses creating tax avoidance schemes to be "named and shamed".

Guest 655- Registered: 13 Mar 2008

- Posts: 10,247

Nice of her for wanting to promote these companies. The big four don't need such publicity but the small companies, like my friend's, will benefit. His business boomed as a result of the publicity people like Reg have provided him.

As I said above there are better ways to deal with tax than make it even more complex and give publicity to the accountancy firms.

Guest 698- Registered: 28 May 2010

- Posts: 8,664

Barry, you have missed the point. Simplifying the tax system and cutting the headline rates would be unfair because millionaire investors would then have more millions to invest in job-creating ventures, which of course wouldn't be fair at all.

I'm an optimist. But I'm an optimist who takes my raincoat - Harold Wilson

Guest 716- Registered: 9 Jun 2011

- Posts: 4,010

Under orders No2 jumps into action.............

howard mcsweeney1- Location: Dover

- Registered: 12 Mar 2008

- Posts: 62,352

Guest 716- Registered: 9 Jun 2011

- Posts: 4,010

Do you think ``our``budding Finance Johnnies will see the light Howard...........nah........

Guest 698- Registered: 28 May 2010

- Posts: 8,664

2691, so we can now expect an equally inane comment from your chief acolyte.

I'm an optimist. But I'm an optimist who takes my raincoat - Harold Wilson

howard mcsweeney1- Location: Dover

- Registered: 12 Mar 2008

- Posts: 62,352

you may be right reg i have just checked back and find the he is an ex oil company executive - no hope of contrition there - egp's the lot of them.

Keith Sansum1

- Location: london

- Registered: 25 Aug 2010

- Posts: 23,948

Maybe barryw is right??/

yes, this system is clearly failing us, the HMC&E is in need of help

We are all being ripped off

Time for robust action

ALL POSTS ARE MY OWN PERSONAL VIEWS

Guest 716- Registered: 9 Jun 2011

- Posts: 4,010

Bankers caused all the global economic mess..........................

Archbishop of Canterbury criticises bankers for 'culture of entitlement'

Justin Welby, member of all-party commission looking into banking standards, throws support

behind a new standards body

Justin Welby, the archbishop of Canterbury, repeated his warning that Britain is in an economic

depression from which it could take a generation to recover. Photograph: Philip Toscano/PA

The archbishop of Canterbury, Justin Welby, has accused bankers of having "a culture of entitlement"

in a scathing critique of the City's ethical and professional standards.

Welby, a member of the cross-party Banking Standards Commission, said bankers should be

required to pass exams in order to raise standards in the industry and restore public trust in the profession.

His comments come as the commission prepares to publish its final report on how to improve behaviour

in London's financial centre. George Osborne, the chancellor, has pledged to incorporate its proposals

into draft legislation.

Guest 671- Registered: 4 May 2008

- Posts: 2,095

"My New Year's Resolution, is to try and emulate Marek's level of chilled out, thoughtfulness and humour towards other forumites and not lose my decorum"

Guest 698- Registered: 28 May 2010

- Posts: 8,664

The archbishop is totally correct. I know he is not supposed to intervene in political matters but I judge his speech to be about ethics, not politics.

I'm an optimist. But I'm an optimist who takes my raincoat - Harold Wilson

howard mcsweeney1- Location: Dover

- Registered: 12 Mar 2008

- Posts: 62,352

i agree peter, church leaders have always commented when they perceive something is wrong in society.