7 November 2012... the Labour Party that is. here we are in the depths of a financial crisis that they are largely responsible for, a crisis that only the private sector and small businesses in particular can get us out of and they dream up yet more wheezes to make life more difficult and expensive for business. Totally mad.

Their latest wheeze is a so called 'living wage' of £7.20 per hour (the minimum wage for the over 21's is £6.19). Milliminor is threatening to award government contracts only to businesses that pay their employees more than this 'living wage'. Ignore the impact of wage inflation, ignore the impact of differentials, ignore the impact on competitiveness, ignore the impact of price inflation, ignore the impact increasing the deficit - what do we have?

Let's get one thing out of the way for a start. We all want a better standard of living that can be derived from more income. I, as a businessman, want more people with more money in their pockets and more in the bank so they can access the services I provide and that is true of all businesses. But this madness of the 'living wage' is just another push towards economic decline and takes us further from economic recovery.

Most businesses are small businesses. Most of these are under capitalised. Most are continuously fighting for their survival. A wage rise for an employee is a wage cut for the employer in these small businesses. Ultimately it is a price rise to the public at large. Wage rises that are not driven by market forces produce nothing in the end but price rises. We have seen this all before in the 70's when the government tried to dictate wage and price policy. It failed.

If we want to tackle unemployment, get economic growth, build prosperous business that provide decent wages and job security then we must step back and allow business to do its job.

Put aside the rights and wrongs of the minimum wage and the 'living wage' for a moment and let us just look at some figures:

Take a person working 40 hours a week and assuming work for 50 weeks a year including holiday pay.

If on the minimum wage they would earn £12,380 per annum. To pay someone this the cost of employment would be £13,095 with employer's NI on top. This will be higher still in larger companies and for all companies soon when auto-enrolment comes in but lets ignore this for now. Such an employer has also to provide the tools for the job, a workstation for instance or tools and all this adds to the cost. They also have to administer PAYE and risk a whole raft of legislation regarding health and safety, discrimination etc etc. They then have to hope that this employee helps you generate the revenue to cover the costs and make the risks worthwhile. Employing someone is not something to be taken lightly.

So, once again ignoring all the risks and indirect costs, in direct costs it is £13,095 p.a. to take someone on at the minimum wage.

The equivalent costs for that person on the 'living wage' would be £15,394 per annum.

The 'living wage' means job losses, it means fewer new jobs created, it means less economic growth.

But what do the employees themselves get out of it?

The minimum wage employee would earn net of tax £10,915 out of the £13,095 it costs the employer. Just over 83% cost/benefit.

The living wage employee would earn net of tax £12,289 out of the £15,394 it costs the employer. The cost/benefit is reduced to under 80%.

Here is an alternative. This is an alternative that I have been suggesting for a long time and is part of the 'flat simple' tax regime that we need. It will not add to employer costs, it will not create more unemployment, it will boost the economy and be largely self-funding through increased economic activity.

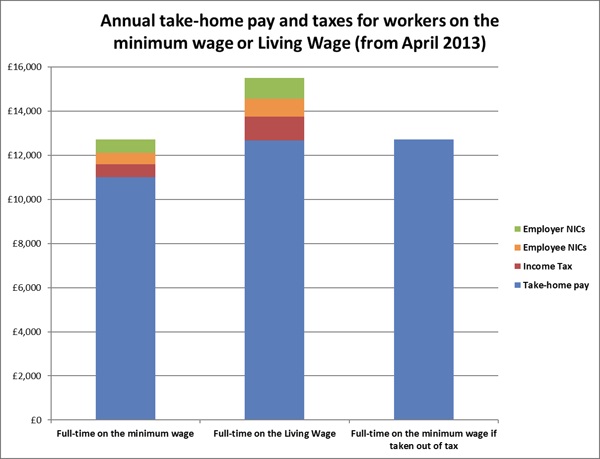

While forgetting the rubbish about a 'living wage' and if we just increase the starting threshold for tax and NI to £12,380 - the same level as someone working on the minimum wage for 40 hours a week for 50 weeks a year. Cost/benefit ratio - 100%. The same outcome as the 'living wage'.

This graphic I found this morning after writing the blog. It seems the LibDems have caught on to Labour's rubbish too... They produced it.

No-one on the minimum wage should pay tax.

(ps - on the day that I wrote this the living wage demand went up to £7.45.... put simply these idiots are demanding more unemployment...)

What might this single rate be? (apart from not high enough) Will it apply to turnover or will the scam-fest of tax-avoision still pertain?