What's next for the economy?

12 January 2013

This is pretty much the big question. Over the last couple of days it is one to which I have been trying to get an answer to while speaking to a range of different economists and investment managers. Here are a few snippets of information, but first regulatory stuff....:

This is pretty much the big question. Over the last couple of days it is one to which I have been trying to get an answer to while speaking to a range of different economists and investment managers. Here are a few snippets of information, but first regulatory stuff....:

What I am saying in this post does not constitute advice to invest. Investment goes down as well as up in value and it is essential advice is taken before making an investment. Expressed here are informed opinions distilled from the best information sources available.

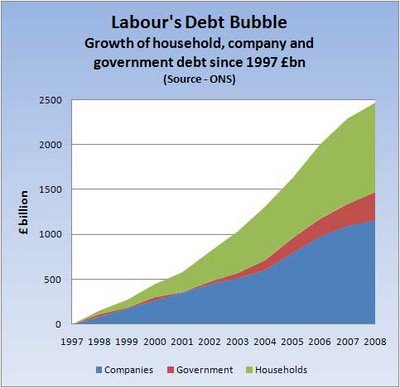

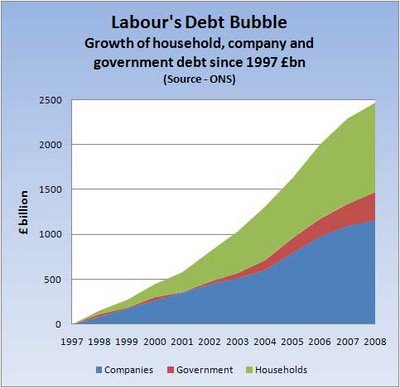

UK Economic Growth. A better year is ahead and growth of 1% can be expected this year. It is likely that averaged over 10 years to 2020 this will work out about the average we can expect. This is what is needed to work out of the system the illusionary 'bubble' of growth built on debt from 2000 through to 2007. There are three major threats to recovery and I will run through these:

Europe. Forget the bravado of certain European leaders, the Euro crisis is not over. The problems the Italians have are greatly exaggerated though but there are some real problems for the Spanish yet to be overcome with a lot of shorter duration debt regularly needing refinancing. Huge, and growing, unemployment rates in many European countries are going to create massive political pressures. Further political problems arise also from getting the 'single economy' the Eurozone needs to survive.

US Fiscal Cliff. We have a fudge at the moment and this is a problem that is yet to be resolved. But this is a different kind of problem to what the Europeans face and is one that will get solved. Do not expect this issue to derail recovery though it has the potential to do so.

The Bond Bubble. The press have exaggerated this threat but it is a real one. Because interest rates have been held so low, so long, bond values could fall like a stone once rates start to rise. Liquidity remains a problem. The good news is that rates are not likely to rise for some years yet simply because the economy is so weak.

On World Growth. The feeling is that China will get a 'soft landing' and their economic growth will be 7.5% to 8% this year. This will help boost the overall world growth rates but the rebalancing of the Chinese economy to a consumer driven one is happening too slowly.

The above chart illustrates one major reason why the domestic UK economic problem is so dire. Labour's failure to continue deficit reduction after 2000 and their ill-considered inflation brief to the Bank of England that ignored levels of private debt, keeping interest rates too low too long while encouraging borrowing and discouraging savings are why we are in the mess we are in. This is without the bank bail-out money.

For those who think UK government debt levels mean Armageddon, think again. Net UK government debt has been reduced by a third - that's right, a third despite the gross government UK debt rising considerably thanks to the deficit problem. Why? Because of QE, the Bank of England has bought up a third of UK government debt so effectively the government owns it own debt and is paying interest to itself. Yes, there will be a cost this this but the latest estimates are that it will not come for 3 to 5 years and that cost will be a significant rise in inflation. The reason for the delay of the inflationary impact of QE being overall economic weakness. In the meantime inflation will remain above the BoE targets due to world market pressures rather than money supply,. This is a real blow to those on fixed incomes, a double whammy of inflation.

- No Philip - I am being very precise in what I am saying. I am referring to the debt when I refer to that and the deficit when I refer to that.

The deficit is down by a quarter, thanks to spending cuts. The 'net debt' by a third as a result of QE, if you understand the fact that QE is done by the Bank of England buying UK Treasury bonds and in that way pumping money into the system. The BoE is wholly owned by HMG and the bank pays the coupon (interest) to HMG, the lender in the first instance. - Your other points Philip. A third dip is not impossible but is viewed as unlikely but even such a triple dip does not mean that the 1% growth figure for 2013 will not be achieved.

Incidentally - a down rating of the UK AAA, if it happens rating is considered not to have much impact and is already costed into the market anyway. It is QE that has helped keep down the interest rates.

A 'debt write' off on government debt to the BoE is also not unlikely - What holds the Chinese economy back from becoming consumer driven is a historical unavailability of, and cultural aversion to, personal unsecured debt. That will change as attitudes evolve through osmosis and cultural exchanges.

- Barry you are very wrong. You are falling back on using financial jargon to baffle the more sensible and it doesn't wash.

Debt is debt. Call it what you like. Put the word net before it. It's still debt.

So the government are using tricks like QE to make things appear less bad than they really are but someone will still have to pay - that's us and our children by the way.

Debt is increasing no matter what words you use. The deficit is higher than the government promised it would be.

By all measures that is an epic fail in my book.

An we will see a triple dip recession. There is no doubt about it. Your position is hope over expectation. - Philip. What I have said is fact. I am not a supporter of QE but the way the government has decided to pump money into the system, printing it basically, means that it is effectively lending to itself. We will all pay for it by inflation but you cannot deny the facts that I have outlined.

http://www.bbc.co.uk/news/uk-politics-20989463

Also there will be no 1% growth this year. We will hit a triple dip recession, no question.Once the markets fully realise this our own bond rates will increase.