The long climb.....

20 April 2013

It is increasingly clear that we are in for a long and slow recovery. There will be no miracle, no fast and accelerating growth rate, we are in for a long slow climb back and it is very likely to be a long time before we reach the levels of economic activity we had before the slowdown started in 2007.

It is increasingly clear that we are in for a long and slow recovery. There will be no miracle, no fast and accelerating growth rate, we are in for a long slow climb back and it is very likely to be a long time before we reach the levels of economic activity we had before the slowdown started in 2007.

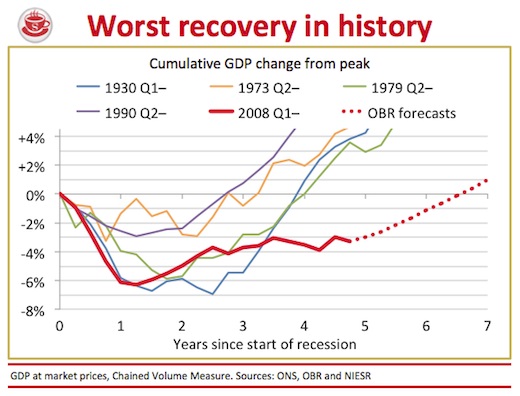

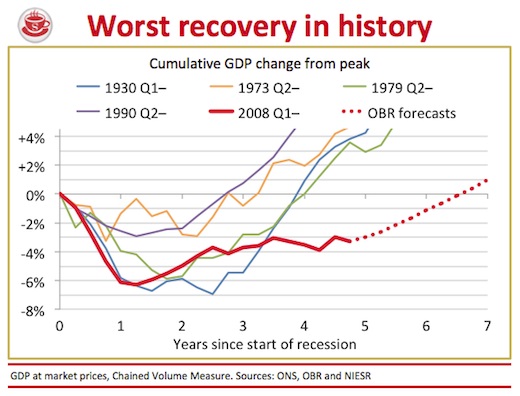

This graph appeared in the Spectator Coffee House blog last week demonstrating the length and depth of this recession compared to previous ones.

This is not surprise, or it should not be however much we hoped for an accelerating upward curve. There are several reasons for this.

1/ The bubble burst - the larger part of the UK economic growth after 2000 was an illusion built on an unsustainable bubble of consumer and government debt. What makes it worse is that many of our overseas customers did exactly the same thing and, in Europe, tied themselves to an insane currency experiment. As an exporting nation we are limited in the speed of our recovery by the ability of our overseas markets to buy our goods.

2/ We have not really seen enough done in the UK to reduce the burden carried by the businesses on whom recovery depends. During the period from 1997 onwards, business has been lumbered with ever more and more red tape, adding to costs. If we want our businesses to go out there and compete winning orders, generating jobs and growth, then this burden must be reduced to make them more competitive. Indeed we should see this as a major opportunity, after all there is no real sign of our European markets doing the same for their businesses, so there is everything to play for.

3/ There has been no real austerity, only talk of austerity. Public spending has not actually been cut in cash terms and there is still a massive deficit adding to our debt burden. Partly this is because of a lack of growth caused by the reasons mentioned above but also the government has not been bold enough with its cuts to public spending.

4/ Taxes are still too high and need cutting. Some taxes could be cut and the result would be more income for HMRC, not less, so the only reason they have not been cut is political expediency. The top rates of taxes should be a priority to cut as these would be more than self-funding and would increase revenue to HMRC and boost growth. Taxes should also be cut faster at the lower levels but for that the spending cuts are needed. No-one on the minimum wage and working 37 1/2 hours a week should have to pay tax.

None of this is rocket science. Osborne knows all this, as does Cameron. So what is stopping them? Political expediency is what is it. Politics is taking precedence over practical economics. Having a coalition does not help of course as the LibDems are ideologically opposed to many of the measures needed. But that should not be an excuse - Cameron and Osborne should call their bluff and make sure what is needed is done. Better to end the pain more quickly than have it dragged out.

- There will be no growth for the UK. There will be no recovery.

When We have a government inventing ideas including an easing to the planning restrictions on house extensions or millions of green jobs which, by the way, are as rare as unicorns this can only spell disaster for the British economy.

Make no mistake We are going down. Our financials sector, what is left of manufacturing, services, welare, increasing debt can only mean one thing - economic ruin.

One Man who recognizes this is, as I alluded to in your last blog Barry, Peter Lilley.

In a very recent coming together of all the parties in Westminster He told them how it was. The video of the meeting is online but to cut to the chase someone has kindly transcribed his words.

http://www.bishop-hill.net/blog/2013/4/20/the-low-carbon-fairy-story.html

It's all too depressing. - LOL, Barry. Tom seems to salivate at every morsel you offer on your blog. In future I shall address you as Professor Pavlov.

A child's rosy-cheeked arse exposed over the knee of a cruel but well intentioned parent, "This hurts me more that it does you." being the caption.

1/The bubble burst, right enough, yet the 'MV Financial Services' , (a marriage between The Marie Celeste and the Titanic), the great vessel of Fortune ploughs on in the benthic gloom.

And the cure for our ills is again the 'hair of the dog' development of smaller and smaller houses for hoped for higher and higher prices. No mention of homes, but instead 'affordable properties', i.e. more public and private debt.

2/ The Green(housi)est Government ever. "If your future looks bleak why not build a Gazebo?"

We can at least agree that the the thrust of 'recovery' does seem to rely upon more and more foreign businesses, for larger and larger profits, involved in increasing personal surveillance. Not just UniversalJobsmatch and the feeding of welfare monies via mobile phones at the bottom end, but real-time PAYE reporting - so burdensome to SMEs (the top-end seems relatively unaffected, funny that - see below). The convenience of C&L, PWC etc., the Cillit Bangs of National Finance, are also ever popular.

3/ (Good old Donald McGill?) Yes, sacking people is not as cheap as it could/will be.

4/ Taxes, of course, will rise steeply after the next election, no matter what the outcome. Whether this will involve any Radical realignment or be more of the partisan-preferment-type, time will tell.

No indeed, none of this is Rocket Science, it's not even seed-drill science.

Our, fairly recent, growing reliance upon the Service Sector, and especially the Financial Services Sub-sector, coupled with the quaint notion, also of recent vintage, that profits should be unaligned to risk must be addressed and the direct proportionality of earnings to tax evasion, in it's many forms, must also be struck down.

You and I Barry, shall not be running out of conversation any time soon.

*http://www.telegraph.co.uk/news/picturegalleries/uknews/7928713/Banned-saucy-seaside-postcards-by-Donald-McGill-go-on-show.html